Strengthening Nepal’s Business Environment: Insights from B-READY 2024–2025

1. Background

The World Bank’s Business Ready (B-READY) framework assesses how effectively an economy enables private sector activity throughout the life cycle of a firm—from entry and operation to growth and exit. Performance is measured across three pillars—Regulatory Framework, Public Services, and Operational Efficiency—and ten business topics.

In the context of B-READY 2024–2025, Nepal is categorized as a lower-middle-income economy in South Asia, roughly 60% of the way toward a fully favorable business environment. Its performance is characterized by pockets of regulatory strength contrasted with a significant “public services gap,” where institutional support, digital infrastructure, and operational efficiency lag behind legal frameworks.

Globally, B-READY 2025 emphasizes three key messages:

- Economies needing the most jobs are often the least business-ready.

- Delivering public services to support businesses is harder than enacting laws, creating a persistent public services gap.

- Firms’ ability to comply with regulations and use public services effectively lags behind regulatory strength, producing an efficiency gap.

2. Key Findings (2024–2025)

- Regulatory quality improved, but implementation weakened.

- Nepal is increasingly finance-friendly, yet structurally harder for starting, trading, and exiting businesses.

- The sharpest declines occurred in Business Insolvency, International Trade, and Operational Efficiency.

3. Overall Business Readiness in Nepal

- Scores range: 72% in Financial Services to 24% in Business Insolvency.

- Pillar-level performance (out of 100):

- Regulatory Framework: 61 (bottom 40% globally)

- Public Services: 42 (bottom 40% globally)

- Operational Efficiency: 56 (bottom 40% globally)

Insights:

Nepal is improving in financial services but faces structural challenges in starting, trading, and exiting businesses.

- Financial Services (71.84): Strong frameworks for secured transactions, credit information, and e-payments.

- Dispute Resolution (60.39): Up-to-date mediation laws and efficient courts; within the top 40% globally.

- Business Insolvency (24.09): Weak infrastructure; no corporate liquidation/reorganization cases completed in the past three years; bottom 20% globally.

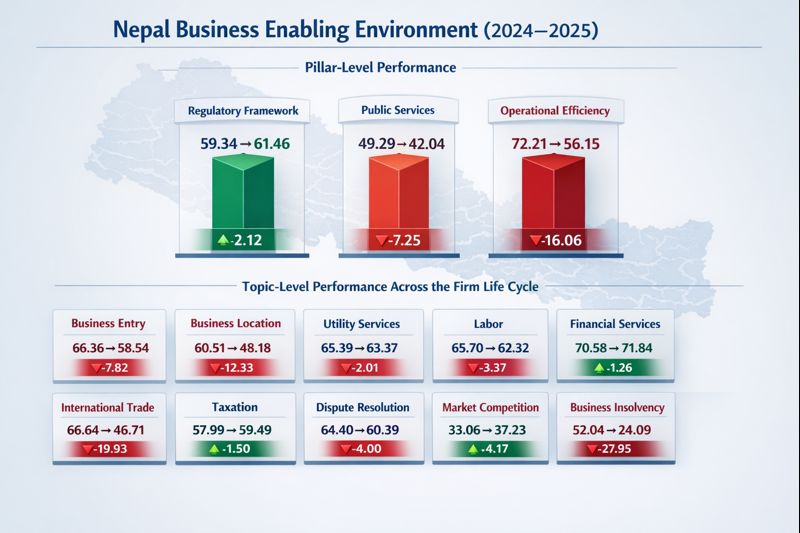

4. Pillar-Level Performance

| Pillar | 2024 | 2025 | Trend |

| Regulatory Framework | 59.34 | 61.46 | 🟢 +2.12 |

| Public Services | 49.29 | 42.04 | 🔻 −7.25 |

| Operational Efficiency | 72.21 | 56.15 | 🔻 −16.06 |

Insights:

- Regulatory Framework: Moderate improvement; laws exist but enforcement lags.

- Public Services: Decline reflects weakening institutional capacity and service delivery.

- Operational Efficiency: Sharp drop signals increased compliance difficulty and inefficient service use.

Regulatory gains are not translating into real-world outcomes for businesses.

5. Topic-Level Performance Across the Firm Life Cycle

| Topic | 2024 | 2025 | Trend |

| Business Entry | 66.36 | 58.54 | 🔻 −7.82 |

| Business Location | 60.51 | 48.18 | 🔻 −12.33 |

| Utility Services | 65.39 | 63.37 | 🔻 −2.01 |

| Labor | 65.70 | 62.32 | 🔻 −3.37 |

| Financial Services | 70.58 | 71.84 | 🟢 +1.26 |

| International Trade | 66.64 | 46.71 | 🔻 −19.93 |

| Taxation | 57.99 | 59.49 | 🟢 +1.50 |

| Dispute Resolution | 64.40 | 60.39 | 🔻 −4.00 |

| Market Competition | 33.06 | 37.23 | 🟢 +4.17 |

| Business Insolvency | 52.04 | 24.09 | 🔻 −27.95 |

Areas Showing Improvement

- Financial Services (+1.26): Improved access to finance and financial infrastructure.

- Taxation (+1.50): Marginal improvement, though compliance burdens remain.

- Market Competition (+4.17): Improvement from a low base; structural weaknesses persist.

Areas of Decline

- Business Entry (−7.82): Starting a business has become more difficult.

- Business Location (−12.33): Persistent challenges in land access, permits, and location-related services.

- International Trade (−19.93): Significant deterioration in trade facilitation and border processes.

- Business Insolvency (−27.95): Severe decline, indicating ineffective exit mechanisms.

Nepal is improving in finance and competition but struggling in starting, locating, trading, and exiting businesses, reflecting persistent public services and efficiency gaps.

6. Why Business Exit Matters

A healthy business environment allows failure without permanently discouraging entrepreneurship. Nepal’s decline in Business Insolvency indicates:

- High personal and financial risk for entrepreneurs.

- Capital and labor trapped in unproductive firms.

- Innovation and risk-taking are stifled.

Weak institutional and operational frameworks for insolvency hamper economic dynamism.

7. Topic-Specific Insights (Structural Dimensions)

- Business Entry: Compliance costs and limited digital services slow registration.

- Business Location: Land access, permits, and information transparency remain problematic.

- Utility Services: Service efficiency and timely connections need improvement.

- Labor: Simplified SME compliance and digital enforcement mechanisms required.

- Financial Services: Strong frameworks exist, but operational efficiency can improve.

- International Trade: Border processes and logistics require urgent reform.

- Taxation: Administration improving, but SME compliance remains costly.

- Dispute Resolution: Relatively efficient, transparent processes.

- Market Competition: Modest improvements; structural weaknesses persist.

- Business Insolvency: Laws exist, but operational infrastructure is ineffective.

8. Policy Implications

- Close the Implementation Gap: Focus on executing, monitoring, and enforcing regulations.

- Strengthen Public Service Delivery: Invest in institutions, digital services, and inter-agency coordination.

- Prioritize Trade Facilitation: Improve customs efficiency, logistics, and border management.

- Reform Insolvency Frameworks: Operationalize laws with clear procedures, trained professionals, and predictable timelines.

- Adopt a Life-Cycle Approach: Support firms from entry → operation → growth → exit.

9. Actionable Reform Recommendations by Ministry

Ministry of Industry, Commerce and Supplies

- Simplify and digitize business entry and licensing.

- Establish a one-stop digital business portal.

- Coordinate B-READY reforms and monitor implementation.

Ministry of Finance

- Expand e-filing, e-payments, and risk-based audits.

- Simplify tax procedures for SMEs.

- Allocate budgets for trade facilitation and insolvency reforms.

- Automate customs and strengthen border management coordination.

Ministry of Physical Infrastructure and Transport

- Accelerate land registration, zoning clarity, and construction permits.

- Invest in logistics corridors, dry ports, and transport infrastructure.

Ministry of Energy, Water Resources and Irrigation

- Improve electricity and water connection reliability.

- Introduce digital tracking and time-bound service standards.

Ministry of Labour, Employment and Social Security

- Simplify labor compliance for SMEs.

- Promote digital inspections and grievance mechanisms.

- Balance worker protection with labor market flexibility.

Ministry of Law, Justice and Parliamentary Affairs

- Operationalize insolvency laws with clear procedures.

- Build capacity of judges, insolvency practitioners, and court officials.

- Expand alternative dispute resolution (ADR).

Nepal Rastra Bank

- Continue reforms for SME and startup financing.

- Strengthen credit information systems and secured transactions.

- Support digital financial innovation while safeguarding stability.

10. Conclusion

Nepal’s B-READY 2025 results reveal a critical imbalance: progress in regulations and finance, but declining service delivery and operational effectiveness. Without urgent reforms in implementation, trade facilitation, and exit mechanisms, regulatory gains will not translate into sustainable private sector growth.

Success depends not on better rules alone—but on making them work in practice for businesses.

11. Annex: Global Benchmarking (Among 101 Economies, 2025)

Overall Business Readiness

| Pillar | Nepal Score | Global Rank | Top Performer | Least Performer |

| Pillar 1: Regulatory Framework | 61.46 | 76 | Czechia (80.73) | South Sudan (36.04) |

| Pillar 2: Public Services | 42.04 | 74 | Korea, Rep. (80.22) | South Sudan (15.51) |

| Pillar 3: Operational Efficiency | 56.15 | 67 | Singapore (79.25) | Central African Republic (35.48) |

Business Enabling Environment

| Topic | Nepal Score | Global Rank | Top Performer | Least Performer |

| Business Entry | 58.54 | 79 | Armenia (95.95) | Equatorial Guinea (32.15) |

| Business Location | 48.18 | 81 | Italy (83.59) | South Sudan (30.44) |

| Utility Services | 63.37 | 72 | Korea, Rep. (97.99) | South Sudan (21.50) |

| Labor | 62.32 | 72 | Taiwan, China (81.41) | South Sudan (48.46) |

| Financial Services | 71.84 | 52 | Azerbaijan (87.16) | Timor-Leste (29.65) |

| International Trade | 46.71 | 85 | Croatia (84.72) | Angola (23.58) |

| Taxation | 59.49 | 34 | Korea, Rep. (75.16) | Central African Republic (24.58) |

| Dispute Resolution | 60.39 | 37 | United States (75.32) | South Sudan (25.41) |

| Market Competition | 37.23 | 84 | Korea, Rep. (78.10) | Timor-Leste (15.28) |

| Business Insolvency | 24.09 | 87 | Korea, Rep. (88.59) | Timor-Leste (0.00) |

Nepal is making progress in financial services but remains structurally challenged in starting, trading, and exiting businesses. Sustainable private sector growth requires strengthening public services, operational efficiency, and exit mechanisms—not only regulations.

World Bank. (2025). Business Ready (B‑READY) 2024–2025. Retrieved from https://www.worldbank.org/en/businessready